Corporate Fraud & Embezzlement Investigation

If you’re here, it’s because you suspect your business is losing money under questionable circumstances. You might have noticed employees acting strangely or even discrepancies in financial reporting. But it’s difficult to pinpoint–and prove–that there’s a problem….

Essential Things to Consider in Remarriage

Today, individuals are divorcing only to remarry a few months or years later. Whether you are male or female, if you have separate property, such as a residence, rental property, gold & silver, stocks, and bonds, or cash in your mattress, you should consider a…

Help for Those Facing Prosecution of PPP and EIDL Loans

This article continues the series of Paycheck Protection Program (PPP) Loans. We are five years into PPP loan prosecutions, and the US Attorneys are still prosecuting egregious cases. President Biden extended the statute of limitations on the PPP loan fraud from 5 to…

Who are Embezzlers in 2024?

Experience has shown that embezzlers are opportunists that find weaknesses in systems and exploit them. The Association of Certified Fraud Examiners issued their Occupational Fraud 2024 Report to the Nations a Global Study[1]. The study shows as it did in the past…

Business Divorces – When partners decide to split

The same principles of tracing assets that apply to martial divorce with the division of assets apply to business ventures where business partners form a business with success and profit in mind. The partners work together for a few years and develop dislikes because…

Key Differences Between a Financial Forensic Investigator and a Certified Public Accountant (CPA)

Attorneys whose clients have financial problems requiring financial analysis and investigation might be unsure if they need a Certified Public Accountant (CPA) or a Financial Forensic Investigator. We want to identify what each does so you can choose wisely according…

Not Caught Up Due to Knowledge

A female entrepreneur was approached by a person who posed as a CPA with whom she had a business relationship in the past. The CPA impersonator referred her to contact an SBA “agent” to help fund a project she was initiating. The entire relationship was fostered over…

IRS Looking at the Sweet Spot

This article is beneficial knowledge for all businesses. The Internal Revenue Service has known where the tax abuse has occurred for years. On September 8, 2023, they announced a new enforcement initiative to use artificial intelligence and other technologies to catch…

Safeguard Your Finances by Protecting Yourself from the FDIC Logo Scam

In the era of online banking and electronic transactions, ensuring the safety and security of your financial information is crucial. Unfortunately, scammers are constantly devising new strategies to manipulate unsuspecting individuals. One such scam involves the use…

How a Business Attorney Can Help Clients Identify Theft

In today’s complex business landscape, the risk of theft and fraudulent activities is a constant concern for businesses of all sizes. With the cost of goods and services rising, corporate fraud is also increasing. To combat this fraud threat, companies often rely on a…

How an Attorney Can Help a Divorce Client Get a Better Settlement

The process of divorce can be emotionally and financially draining for your clients. Dividing assets and liabilities presents a significant challenge, especially when one spouse suspects the other of hiding or dissipating assets. In such cases, the technique known as…

Why Sage Investigations is Your Trusted Forensic Accounting Team

Do you need to follow the money? Unfortunately, corporate fraud and asset misappropriation are common in all businesses, regardless of size. In fact, studies show that 57% of fraud is committed by company insiders, with employee theft costing businesses nearly $50…

Forensic Accountant for Divorce – Sage Investigations

Are you in the midst of a divorce and seeking the expertise of a financial investigator for divorce proceedings? Look no further. Our team of skilled professionals specializes in providing comprehensive financial investigation services tailored specifically to divorce…

Unveiling the Power of Forensic Accountants in Combatting Asset Misappropriation and Check Fraud

Asset misappropriation and check fraud pose significant threats to businesses and organizations. Detecting and preventing such fraudulent activities is a complex task requiring expertise and specialized knowledge. This is where forensic accountants, armed with their…

The Pitfalls of Inadequate Tracing in Divorce Proceedings: A Recipe for Financial Loss

One crucial aspect of ensuring your client gets the best settlement is the process of accurate tracing, which involves identifying and quantifying marital and non-marital assets to ensure a just distribution. Unfortunately, when tracing is done incorrectly or…

Your Trusted Assistant

Everyone in business has a trusted assistant—someone you hire for the job or someone through working together. As you progress in your business, you rely increasingly on that person. Their responsibilities increase, and they put you at ease when under stress by…

How to Avoid Intrusion and Account Takeover

The use of computers in business is as necessary as breathing fresh air. Businesses with access to public information such as credit card numbers, social security or employment identification, dates of birth, names, and addresses must maintain a secure computer server…

Estate Planning Before Divorce

If you plan to be married, it is in your best interest to protect your assets in case of a divorce. You would much rather be financially sound than devastated if a divorce does occur. The primary way to protect your assets is to locate an Estate and Trust Attorney to…

Understanding Employee Retention Tax Credit

Number one on the IRS 2023 Dirty Dozen list is the Employee Retention Tax Credit (ERTC) misuse. This refundable tax credit is designed to reward business owners for retaining employees throughout the COVID-19 pandemic and its aftermath. IRS is cautioning business…

Introducing the Litigation Support Component of DIO

With advances in technology and the growing complexity of global banking and business, numerous new avenues of deceit are created daily for swindlers to mask illegal and fraudulent activity. The money movement between companies, governments, and individuals has become…

Actual Fraud vs. Constructive Fraud

In divorce matters, a spouse may be exposed to constructive fraud through the waste of community assets by the other spouse. In community property states, spouses have a fiduciary duty to each other and place trust in each other to be responsible for the community…

How to Simplify Your Complex Divorce Cases

With advances in technology and the growing complexity of global banking and business, numerous new avenues of deceit have been created for swindlers to mask illegal and fraudulent activity. In this digital age, the movement of money between companies, governments,…

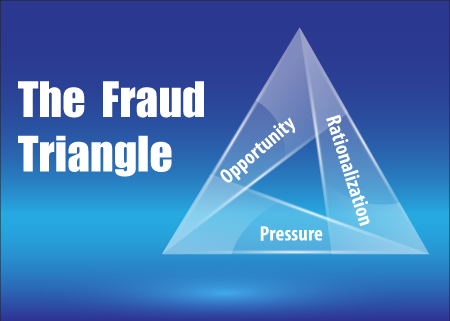

Help Your Clients Detect Fraud

The Association of Certified Fraud Examiners’ “Report to the Nations – 2022 Global Fraud Study” revealed how occupational fraud is detected in business[1]. Occupational fraud occurs when an employee, manager, or executive of an organization deceives the organization…

Surviving Burnout and How to Rekindle the Fire

It has been published that some Attorneys have reached a point in their careers where they are burned out and maybe even considering a change of profession. It is known that the COVID-19 months of isolation have taken their toll and have reduced the desire for some…

Forensic Accountant Coalesces with an Expert Witness

Forensic accounting[1] investigates financial transactions and business situations to obtain the truth and develop an expert opinion regarding possible fraudulent activity. Two areas of expertise make up the field of forensic accounting: Litigation support and…

Public Service Announcement: Fraud prevention through knowledge

As a Certified Fraud Examiner (CFE) of 30-plus years and retired federal agent, it is part of my job to educate the community and provide information that will help people identify scams and prevent them from losing their hard-earned money. The Sage Team has compiled…

The Evidence Needed to Prove Your Clients Case

Early on, the Texas Supreme Court established the basic principles of tracing separate property. Where separate and community funds were commingled in a bank account, it was considered impossible to segregate the funds.[1] In 1976 James D. Stewart adopted from Farrow…

Fraud Investigation by the Numbers 2022 Version

It is nearing the end of 2022, and like every other year, fraud is the cases worked on by the Sage Team. The Sage Team has been hired to handle fraud cases by corporations, attorneys, and accounting departments. We saw a lot of occupational fraud throughout the year,…

Tracing Simplified Using DIO

Tracing Essentials If your client is contemplating marriage after the death of a spouse or divorce and the client was left with a high net worth, it is necessary to protect their separate property before their remarriage. It is best since you are marshaling the assets…

Help Your Client Prevent Expense Fraud in Their Business

Business attorneys like yourself are always trying to help clients prevent fraud in their businesses. To prevent fraud, it is critical first to encourage your clients to develop a policy to deter fraud and make employees aware of the impact of fraud on the…

Victimization by Scammers Adjusts to the Internet Age

During the tax shelter years, individuals would invest in schemes to save money on federal income tax owed. As a result, scores of people lost money and became part of a con man’s “sucker list.” In early 2001, there was a fraud scheme in Las Vegas…

150,000 and Personal Identity Lost in Cryptocurrency Romance Scam

Written by Edmond Martin, CFE, TBCI, and Daniel Fannin, CPA, CFE, CAMS – of Sage Investigations, LLC. A retired individual and his wife divorced after more than 25 years of marriage. They sold their family home, and he received half of the proceeds totaling $175,000,…

Claims of Reimbursements, Offset

The Texas Constitution, Article XVI, Sec. 15, defines Separate Property as all real and personal property of a spouse owned or claimed before marriage, and that was acquired afterward by gift, devise, or descent shall be the separate property of that spouse.[1] States…

Best Practices for Tracing

All of the below best practices are implemented by Sage Investigations, LLC in the bank analyses and the tracing analyses through algorithms and DIO, a proprietary technology. Utilize technology to convert account activity from paper or PDF formats to a format that…

Robbery by the Silver Tongue Instead of the Silver Pistol

The old style of robbery is resurging but with a different slant. Instead of robbing the bank, they rob the customers or you with a silver tongue in a romance scheme. Individuals emerging from COVID want the freedom of 2018 – 2019, but things have changed. We are now…

The Advantage of Tracing & Characterization of Property in Divorce Matters

The time and circumstances of its acquisition determine the nature of property as separate or community. The Texas Constitution, Article XVI, Sec. 15, defines Separate Property as all property, both real and personal, of a spouse owned or claimed before marriage, and…

Part 2 of Cryptocurrency; The good, the bad, and the ugly

The not so Good Cryptocurrencies (Crypto) such as Bitcoin, Ethereum, Litecoin, and hundreds more are hot commodities in online trading, and an intelligent investor can make a big profit[1]. Things have changed in one month. A Wall Street Journal Opinion by Andy…

Cryptocurrency: The good, the bad, and the ugly

The Good Cryptocurrencies (Crypto) such as Bitcoin, Ethereum, Litecoin, and hundreds more are hot commodities in online trading, and it’s possible for a smart investor to make a big profit[1]. The Bad The prospect of quick riches can blind individuals to the…

Cybercrime – Account Take Over (ATO) Scheme

Account takeover fraud (ATO) generally happens when a cybercriminal gains access to the victim’s login credentials to steal funds or information. Fraudsters digitally break into a financial bank account to take control of it and have a variety of techniques at…

Avoid Ukrainian Scams

The increase of scams continues to attempt to separate good-hearted people from their money. Scammers know most people, regardless of their country of origin, are good-hearted people, and they cannot resist taking advantage of tragedies to devise a scheme that will…

Fraud Between Family Members

Often, you hear on the news, read on the internet, or in a magazine about one family member stealing the identity of another family member; parents securing credit cards, purchasing a vehicle, stealing tax refunds and insurance checks, or securing a mortgage in the…

Beware of the Greed Syndrome

In the previous articles (reference September and October), we discussed the estate of individuals that have amassed substantial wealth and how executors and beneficiaries react to the exposure to such wealth. An executor or executrix of an estate is an individual…

Various Means Used to Steal Money from Inheritance, Chapter Two

Based on cases and the experience Sage Investigations, LLC gleaned from those cases, Sage has identified an area of investigation that we refer to as the Inheritance Investigations. Weekly we receive a call from frustrated individuals dealing with an executor,…

Various Means Used to Steal Money from Inheritance, Chapter One

Based on cases and the experience Sage Investigations, LLC gleaned from inheritance cases; Sage has identified an area of investigation that we refer to as the Inheritance Investigative. Weekly we receive a call from frustrated individuals dealing with a brother or…

Help your clients win with financial technology!

Sage Investigations transforms investigations from weeks or months to days with their advanced technology proprietary software, DIO. DIO financially analyzes bank accounts, brokerage accounts, and credit card accounts in theft and embezzlement cases, divorce…

You Stole My Heart and My Money

According to the Federal Trade Commission, consumers reported losing more than $3.3 billion to fraud in 2020, up from $1.8 billion in 2019. Nearly $1.2 billion of losses reported last year were due to imposter scams, while online shopping accounted for about $246…

How the New Administration and Congress will Affect the IRS and All Taxpayers

News articles reveal that the Biden Administration is proposing an increase in the IRS budget by $13.2 billion to help with modernization, cybersecurity, and to help with compliance. It is expected that by employing 8,493 more full-time employees, every $1.00 spent on…

The Impact of Relevant Conduct on Taxpayers

IRS Criminal Investigation Special Agents use the specific items method of proving income because it is generally the easiest method of proof that the IRS has in its arsenal to prove unreported income. IRM 9.5.9.4 states, “Where the government is using the specific…

Discovery Actions Beneficial to the Defense

It is extremely important for an expert witness working for a defense attorney on a civil or criminal case to have access to discovery. Today there are methods of sharing files through ShareFile, YouSendIt, RapidShare, and other file sharing software like Dropbox,…

Follow the Money and Assist Your Client

Over the years, when investigating financial matters, it has been determined essential to “follow the money.” In training, the Internal Revenue Service fostered the concept of “full financial investigation.” In the private sector, “following the money” is key to…

Payroll Protection Program (PPP) Loans Round 2

This article continues the series of PPP Loan matters. On April 2, 2020, the U.S. Small Business Administration (SBA) posted an interim final rule announcing the implementation of sections 1102 and 1106 of the Coronavirus Aid, Relief, and Economic Security Act (CARES…

Attorneys Beware: scammers are after you

Beware the scammers are attempting to gain access to your trust accounts. Recently, an attorney who received an email advising that a Swedish company needed the assistance of an attorney to complete a business transaction contacted Sage Investigations LLC. The…

Why is a Kovel Letter Important?

An attorney should always issue a Kovel Letter to a forensic accountant after being hired by a client to represent them in a civil or criminal tax matter. What is a Kovel letter? It is a letter based on a landmark federal case, United States v. Kovel, 296 F.2d 918…

Protect Your Client from Engaging in Hard Money Lending

The definition of Hard Money Lending is fairly simple: a Hard Money Loan is a loan of “last resort” or a short-term “bridge loan.” Bridge Loans are loans of short-term duration that are typically a temporary solution to longer term financing from more…

Due Diligence Helps Manage Risk

What is due diligence? (1) The care that a reasonable person exercises to avoid harm to their person, finances or that of another person. [1] (2) The process of obtaining and evaluating details about the subject, entity, or investment opportunity before making a…

Paycheck Protection Program (PPP) Forgiveness of the Loan Proceeds

This article continues the series on PPP loans but relates to the forgiveness of the SBA PPP Loan. Starting in October 2020, a recipient of a PPP Loan has ten months to report to its lender the disposition of the loan proceeds. The reporting can be done on Form 3508,…

Be Skeptical about Promissory Notes Sold as Safe Investments

In April 2009, the Securities and Exchange Commission issued a notice to investors entitled, Broken Promises: Promissory Note Fraud (U.S. Securities & Exchange Commission 2009).The notice defines a promissory note as a form of debt—similar to a loan or an IOU—that…

Intent vs. Willfulness

In Austin, TX, an individual convicted of conspiracy recently had his conviction overturned by the 5th Circuit Court of Appeals in New Orleans. During oral arguments for the appeal, the Austin American–Statesman newspaper stated, “The federal judges weighing his…

Beware of Journal Entries that Create Income

When reviewing transactions in an accounting system it is important to pay particular attention to journal entries. Journal entries are used to adjust accounting records for activities that are not cash in nature. When dealing with an accrual accounting system,…

Fraud on the Cares Act – Paycheck Protection Program (PPP)

The Paycheck Protection Program (PPP) initially authorized up to $349 billion in forgivable loans to small businesses to pay their employees during the COVID-19 crisis. All loan terms were established to be the same for everyone. The loan amounts will be forgiven as…

Dispersing Employee Credit Cards

As a way to stay on top of company expenses, my credit card company recently recommended I provide my employees with their own business credit card. If you’re in business for yourself, this has probably happened to you. The benefits outlined in their sales brochure…

UPDATE!! During the COVID-19 Pandemic, Fraudulent Activities Become Evident

With isolation caused by the Coronavirus pandemic, surviving businesses have discovered fraudulent activities (Read more). Business owners have had time to review their business activities, CPA’s continue to work on the company books and reconcile bank accounts. They…

The Disgruntled Bookkeeper

Income tax evasion and fraud occur daily in the United States, and Internal Revenue Service (IRS) studies show that the largest arena of fraud is the small solely-owned business. The average citizen receives wages or a salary and taxes are withheld, therefore their…

Asset Misappropriation by Credit Card Fraud

The Association of Certified Fraud Examiners recently issued its Report on Fraud to the Nation for 2014. The report cites three major areas of occupation fraud: asset misappropriation, corruption, and financial statement fraud. “Small businesses are both…

Asset Misappropriation by Check Fraud

The Association of Certified Fraud Examiners recently issued its Report on Fraud to the Nation for 2014. The report cites three major areas of occupation fraud: asset misappropriation, corruption, and financial statement fraud. “Small businesses are both…

The Difficulties of Dying With and Without a Will

Decedent Dies Intestate It is important to know the laws in the state in which you reside to understand your position involving a death in the family and to avoid the frustration and confusion that results. Take time for family matters and the funeral. Most…

Why Did My Business Partner Steal from Me?

Experience has shown that individuals steal from their business partners for a number of reasons including to support a habit including drugs, gambling, women. But the main reason is greed for money and easy access to the proceeds of the business when control systems…

Collusion Between Controller and IT Staff Results in Embezzlement

The Association of Certified Fraud Examiners “Report to the Nations – 2014 Global Fraud Study” reveals that there are “Red Flags” to be considered when a business is experiencing financial difficulties or things just don’t feel right, including: the suspect was a…

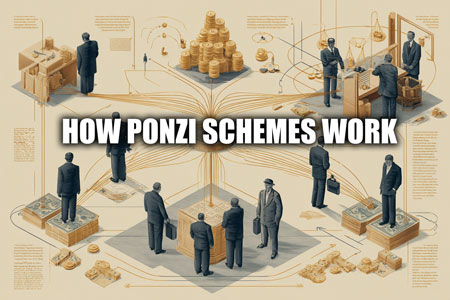

Ponzi Scheme Characteristics

In the past I was fortunate enough to investigate many fraud schemes including a number of investment Ponzi schemes, including: clothing and apparel, foreign currency exchange, promissory notes, oil and gas royalty limited partnerships, and real estate limited…

Ponzi Schemes of Greed Continue During the Corona Virus

The following is a follow up to a June 2020 article issued by Sage Investigations, LLC, regarding Ponzi Schemes. https://www.sageinvestigations.com/articles/why-do-we-continue-to-see-ponzi-schemes-in-the-news/ According to the Securities and Exchange Commission’s…

Beware of Caregivers

A study published in Public Policy & Aging Report (1) finds, “financial exploitation of older adults and diminished financial capacity results from age-related cognitive impairments—both pose major economic threats. “ The author continues, “The problem is…

Necessary Records and Testimony in Financial Cases

Most financial investigations either civil or criminal involve tracing the movement of money. As it relates to civil allegations, matters may involve theft or embezzlement of company assets, assets hidden in a divorce case, diverting business profits to personal use,…

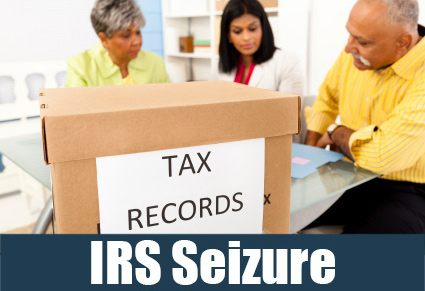

IRS Seized Bank Accounts for Alleged Structuring of Deposits

Every day brings a new story about the IRS seizing bank accounts of American citizens. From grocery stores to dairy farms, from construction companies to other small businesses; if cash comes in, so does the IRS. In days past the IRS Criminal Investigations (CI)…

The Audit Trail Report Hidden in Most Accounting Software

When it comes to fraud investigations, the Audit Report, found in most accounting software, is a very important tool. In years past, the Audit Report for software like Peachtree or QuickBooks could be turned off. Today the Audit Log or Report operates automatically…

Interviewing Defendants in Federal Criminal Cases

Successfully interviewing defendants in Federal criminal cases requires specialized skills and instincts. Sage investigators possess both. We put 26 plus years of experience as an IRS Special Agent work for you and your client to make sure we get what we need to get…

The Impact of a Fraud Investigation

At times federal agencies—IRS and FBI—get information that leads to the execution of a search warrant at an individual’s place of business and possibly their residence. This is generally a shocking activity for employees, clients, and family members. There are a…

Complex Cases Made Simpler

With advances in technology and the growing complexity of global banking and business, numerous new avenues of deceit have been created for swindlers to mask illegal and fraudulent activity. In this digital age, the movement of money between companies, governments and…

Identity Theft of a Retired IRS Special Agent

What is “Identity Theft?” Identity theft is when someone uses your personal information – such as your name, Social Security number or other personally identifying information – without your permission, to commit fraud or other crimes. Identity theft is a serious…

Badges of Fraud

IRS employees are trained to look for “badges of fraud” IRM 25:1.2.3 (04-24-2014) while carrying out their functions as revenue or collection agents. These badges include, but are not limited to, the following items: Omitted sources of income Fictitious or…

IRS Releases Scam Phone Call Alert

I was recently contacted via telephone by a man with a Middle Eastern accent who told me he was with the IRS. He claimed I owed income taxes and stated that if I did not send him money he would send IRS Agents to have me arrested. When I asked how much I owed he said,…

Consumer Fraud

As people lead their lives during this era of Covid-19, fraudulent activities perpetrated against the public continues. The simple task of selling furniture on OfferUp can cause an individual to be drawn into the web of the fraudster. Also, today individuals’ use…

During the COVID-19 Pandemic, Fraudulent Activities Become Evident

With isolation caused by the Coronavirus pandemic, businesses will discover fraudulent activities. Owners will look at the activities of their business, the company books, bank accounts, the decrease in sales, and the increase in inventory and realize it all does not…

The Importance of Maintaining Proper Records for the IRS

The Internal Revenue Code requires businesses to maintain records of their activities including invoices for services rendered, bank records and invoices for expenditures made for business purposes. It is also wise to have a system of accounting, a spreadsheet with…

To Follow Money, Books and Records Are Needed

Any financial investigation, specifically income tax (civil or criminal), partnership embezzlement, and divorce, require books and records to be successful in tracing expenses and following the money. Without them the chances of success are diminished. In income tax…

Taxpayer Decision… Auditor or Special Agent

We read in the newspaper that the number of audits is down to less than 1%. In the Kiplinger article dated April 30, 2014, the Commissioner of the Internal Revenue Service (IRS) advised the agency will perform 100,000 or fewer audits this year. The odds are…

Dealing with the Internal Revenue Service for Preparers and Taxpayers

The Tax Cuts and Jobs Act of 2017 (Public Law 115-97) modified the child tax credit (CTC) to provide a nonrefundable credit for qualifying dependents other than children (ODC) and amended Section 6695(g) to add due diligence requirements to cover eligibility to file…

How to Select a Forensic Accountant

What is Forensic Accounting? Forensic accounting, sometimes called investigative accounting, is the application of accounting concepts and techniques to legal problems. Forensic accountants investigate and document financial fraud and white-collar crimes such as…

Do You Need a “Business Fraud” Forensic Accounting Expert Witness?

Edmond (Ed) Martin from Sage Investigations brings insight, understanding, integrity, and professional objectives with no bias. Knowledge Training Accounting degree Skills Education Experience With Ed’s knowledge and skills developed over 50+ years as an investigator,…

The Care and Feeding of a Testifying Expert Witness

In civil financial cases that involve following money—deposits or disbursements— through bank and brokerage accounts, the testifying expert is provided with the legal documents, discovery documents (bank, brokerage statements, and credit card statements), admissions…

The Loneliness Epidemic Is Fueling the Romance Scam Epidemic

Written by DL Garren This article is to educate and protect you and your loved ones from online scammers during this holiday season and beyond. Please be sure to pass this information forward. The Internet is like the wild wild west. It is uncontrolled and where…

Embezzlement? Let me count the ways.

This article is a supplement to the earlier article “Who Are Embezzlers? Misappropriation of funds is a method of money theft of which embezzlement is a common form. This form of crime involves a person who steals something he/she possesses and controls but does not…

Who are Embezzlers?

Experience has shown that embezzlers are opportunists that find weaknesses in systems and exploit them. The Association of Certified Fraud Examiners issued their 2018 Report to the Nation a Global Study[1]. The study shows that employees commit the largest percentage…

Embezzlement: A Tale of Two Victims

The victims of occupational or corporate fraud (asset misappropriation, embezzlement, etc.) can range from individuals to several entities including, small business, public companies, government entities, not for profit entities, estates and trusts, and other…

Embezzlement in Medical and Dental Practices is a Real Thing

Guest Author: Laurie M. East, CPA Theft and embezzlement are widespread in healthcare, and according to the Association of Certified Examiners, approximately $25 billion annually is lost in medical practice offices from theft and embezzlement by employees. According…

12 Top Tips to Reduce Employee Theft

How to handle theft by employees and what to do to prevent theft in a small business setting. President Ronald Reagan advised Soviet President Mikhail Gorbachev at the arms control agreement that he would “trust but verify;” so should a small business owner do. As a…

FAQs for Hiring a Private Investigator to Locate People or Surveil a Spouse

By Fraud Expert, Ed Martin

Preparation for hiring a PI to locate a person or conduct surveillance.

1. Determine who, what, when, why and your budget

2. Seek a cost estimate.

3. Secure a written contract from the PI

…

Preparation for an Estate

Scenario: A number of years ago a dominant sibling took over the operation of a business from the elderly founder of a company. This sibling has made some poor decisions and has allowed greed to enter his heart. What should the other siblings do to attempt to save the…

Top 10 reasons why Professional Private Investigators pursuing fraudulent activities should use the services of Cynic Inc www.cynic.com

1. An opportunity to expand your fraud investigation business by allowing us to take care of your back office services, such as, the input of bank, brokerage and credit card data.

2. Our fraud support services are better, cheaper, and faster than spreadsheet i…

Innocent Spouse in the Eyes of IRS?

by Ed Martin, CFE, Tax Fraud Expert

The Internal Revenue Service sets the bar high for individuals to meet the Innocent Spouse guidelines.

Important: Form 8857 Summary of Instructions:

The IRS says must complete your paper work, Form 8857, attach…

Fraud Investigation by the Numbers

by Fraud Expert, Ed Martin

With continuous construction in Austin, Texas you may be hired to investigate the misappropriation of construction funds by their contractor. The investigator will ask himself / herself, where do I start? The followi…

Mining the Mountain of Digital Discovery

by Jason Slick, President, Cynic Inc.

In today’s global economy the importance of data organization and classification has become the cornerstone on which a financial investigation relies.Everything from converting to digit…

The Truth About Frivolous Tax Arguments

By Fraud Expert, Ed Martin

From www.irs.gov

I. The Voluntary Nature of the Federal Income Tax System

A. Contention: The filing of a tax return is voluntary

B. Contention: Payment of t…

Embezzlement Awareness

by Fraud Expert, Ed Martin

When do people embezzle or abuse the company? Generally, three things have to be present before someone commits fraud or embezzles: need, opportunity, and rationalization. This is known as the “triangle of fraud.�…

What to Do When IRS Criminal Investigation Contacts You

by Fraud Expert, Ed Martin

If you are unfortunate enough to have IRS Criminal Investigation (CI) target you and execute a search warrant on your residence, cars, and small business here is what to expect. An IRS Special Agent with informatio…

How to Reduce Employee Theft

by Fraud Expert, Ed Martin

6 Tips to minimize fraud risk:

- Protect your money: Have company bank statements sent to the home of the business owner, not directly to the office, to demonstrate that you are paying attention to t…

Subscribe and Never Miss a Post

Services to Help You Prevail

Let our 50 years of experience work for you. Our experts efficiently and quickly follow the money and analyze your complex financial data to find the facts you need to make wise decisions.

Get in Touch

At Sage Investigations, we deliver clarity about what has to happen next and confidence that you will know about the fact about the money, and have evidence to win your case. Contact our team when you need forensic accounting, financial litigation support, tracing, or an expert financial witness. We can help you.

Contact Us For a Free Consultation

Please fill out the form below and we will contact you shortly or call our office at 512-659-3179.

“Our clients come to us when they need help money traced. Our goal is to give them the evidence they need to prevail.”

“Our clients come to us when they need help money traced. Our goal is to give them the evidence they need to prevail.”

Edmond J. Martin

(512) 659-3179

edmartin@sageinvestigations.com

Subscribe and Never Miss a Post

Corporate Fraud & Embezzlement Investigation

If you’re here, it’s because you suspect your business is losing money under questionable circumstances. You might have noticed employees acting strangely or even discrepancies in financial reporting. But it’s difficult to pinpoint–and prove–that there’s a problem….

Essential Things to Consider in Remarriage

Today, individuals are divorcing only to remarry a few months or years later. Whether you are male or female, if you have separate property, such as a residence, rental property, gold & silver, stocks, and bonds, or cash in your mattress, you should consider a…

Help for Those Facing Prosecution of PPP and EIDL Loans

This article continues the series of Paycheck Protection Program (PPP) Loans. We are five years into PPP loan prosecutions, and the US Attorneys are still prosecuting egregious cases. President Biden extended the statute of limitations on the PPP loan fraud from 5 to…

Who are Embezzlers in 2024?

Experience has shown that embezzlers are opportunists that find weaknesses in systems and exploit them. The Association of Certified Fraud Examiners issued their Occupational Fraud 2024 Report to the Nations a Global Study[1]. The study shows as it did in the past…

Business Divorces – When partners decide to split

The same principles of tracing assets that apply to martial divorce with the division of assets apply to business ventures where business partners form a business with success and profit in mind. The partners work together for a few years and develop dislikes because…

Key Differences Between a Financial Forensic Investigator and a Certified Public Accountant (CPA)

Attorneys whose clients have financial problems requiring financial analysis and investigation might be unsure if they need a Certified Public Accountant (CPA) or a Financial Forensic Investigator. We want to identify what each does so you can choose wisely according…

Not Caught Up Due to Knowledge

A female entrepreneur was approached by a person who posed as a CPA with whom she had a business relationship in the past. The CPA impersonator referred her to contact an SBA “agent” to help fund a project she was initiating. The entire relationship was fostered over…

IRS Looking at the Sweet Spot

This article is beneficial knowledge for all businesses. The Internal Revenue Service has known where the tax abuse has occurred for years. On September 8, 2023, they announced a new enforcement initiative to use artificial intelligence and other technologies to catch…

Safeguard Your Finances by Protecting Yourself from the FDIC Logo Scam

In the era of online banking and electronic transactions, ensuring the safety and security of your financial information is crucial. Unfortunately, scammers are constantly devising new strategies to manipulate unsuspecting individuals. One such scam involves the use…

How a Business Attorney Can Help Clients Identify Theft

In today’s complex business landscape, the risk of theft and fraudulent activities is a constant concern for businesses of all sizes. With the cost of goods and services rising, corporate fraud is also increasing. To combat this fraud threat, companies often rely on a…

Services to Help You Prevail

Let our 50 years of experience work for you. Our experts efficiently and quickly follow the money and analyze your complex financial data to find the facts you need to make wise decisions.

Get in Touch

At Sage Investigations, we deliver clarity about what has to happen next and confidence that you will know about the fact about the money, and have evidence to win your case. Contact our team when you need forensic accounting, financial litigation support, tracing, or an expert financial witness. We can help you.

Contact Us For a Free Consultation

Please fill out the form below and we will contact you shortly or call our office at 512-659-3179.

“Our clients come to us when they need help money traced. Our goal is to give them the evidence they need to prevail.”

Edmond J. Martin

(512) 659-3179

edmartin@sageinvestigations.com

Call

Call