When reviewing transactions in an accounting system it is important to pay particular attention to journal entries. Journal entries are used to adjust accounting records for activities that are not cash in nature. When dealing with an accrual accounting system, journal entries can be used to create income, which impacts financial statements. If company profits are used as a basis for commissions or shareholder distributions, a controlling person within the company can use journal entries to manipulate company profits and commissions.

When reviewing transactions in an accounting system it is important to pay particular attention to journal entries. Journal entries are used to adjust accounting records for activities that are not cash in nature. When dealing with an accrual accounting system, journal entries can be used to create income, which impacts financial statements. If company profits are used as a basis for commissions or shareholder distributions, a controlling person within the company can use journal entries to manipulate company profits and commissions.

Case Study: A state-regulated small business corporation receives funds from customers for payment of a customer mortgage liability to assist the client with reducing their liability more rapidly. The corporation earns a small fee on each transaction as well as a small semi-annual audit fee. A knowledgeable CFO with no criminal background works in the accounting system on a daily basis and perceives a need for money to develop a nest egg for his family’s future. The CFO realizes that he has access to the cash reserve built up in the bank account from customer payments, and decides to make journal entries that reflect an increase in profits in order to earn commissions to meet his needs.

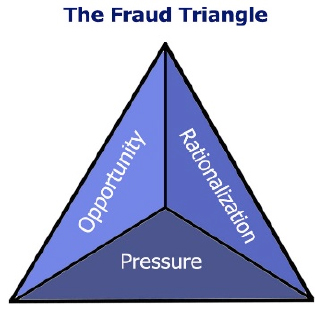

Has the CFO in this case study committed fraud by diverting customer funds to personal assets? The Donald Cressey model of the Fraud Triangle can help you answer this question. The Fraud Triangle comprises a pyramid with segments labeled pressure, opportunity, and rationalization.

According to the Association of Certified Fraud Examiners, “the first leg of the fraud triangle represents pressure, which motivates the crime in the first place.” Pressure may come from debt, addictions, or desire for status symbols. In our case study the CFO feels pressure to build up a personal nest egg. The second leg is “perceived opportunity, which defines the method by which the crime can be committed. The person sees some way he can use (abuse) his position of trust to solve his financial problem with a low perceived risk of getting caught.” In our case study, the CFO’s opportunity is the accrual of income-generating commissions. The third leg is rationalization, in which the “fraudster justifies the crime to himself in a way that makes it an acceptable or justifiable act.” The CFO rationalizes that he is entitled to the money, he is underpaid, and his associates have cheated him.

In litigation support matters, consider the Fraud Triangle, and beware of journal entries, especially when dealing with a large number of transactions and a large volume of customer money. If you need forensic accountant help with complex accounting matters call Edmond J. Martin Chief Investigator, at Sage Investigations, LLC or email edmartin@sageinvestigations.com or call 512-659-3179.

Reference

http://www.acfe.com/fraud-triangle.aspx

Call

Call